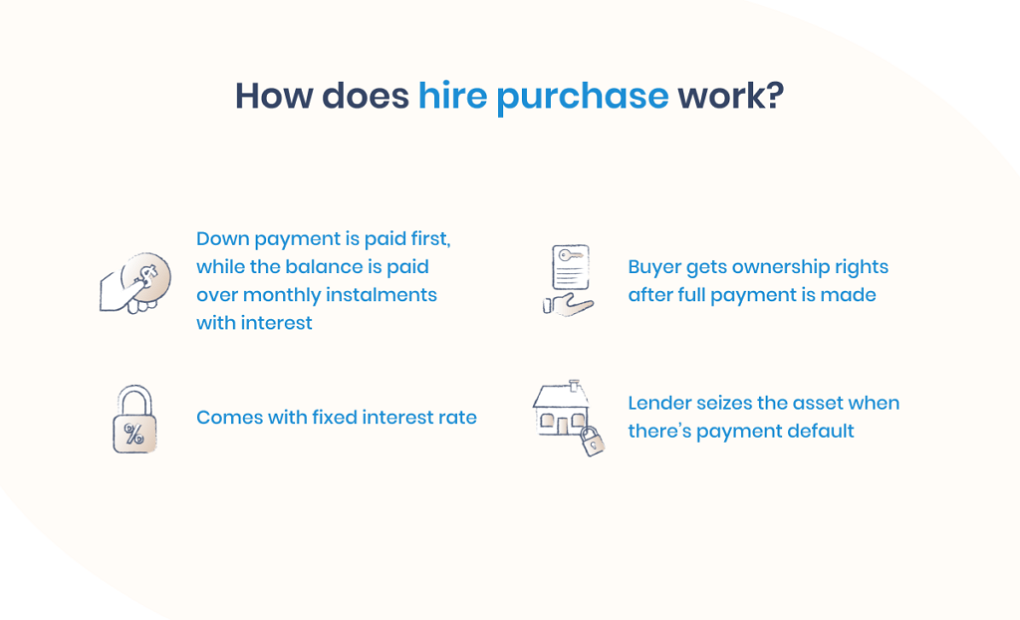

Hire purchase is quickly becoming one of the options when looking to own high-value assets. It is the best option for a buyer who cannot pay the full cost of the items they need upfront. In the case of a hire purchase agreement, one needs as little as 10% of the total cost. When they pay this amount, known as a downpayment, they can acquire and use the goods as they clear the amount in installments.

Hire purchase terms and conditions

There is a need to read the fine print before one commits to purchase assets on hire purchase terms. A hire purchase agreement not only provides you the chance to understand your rights, but it also makes you a smart and informed customer. When one overlooks these terms and conditions, they put at risk their money, time, and effort. In this post, we try demystifying hire purchase by looking at the common terms and conditions.

Common terms and definitions in hire purchase agreements

Terms are words used in a hire purchase agreement and here are their meaning.

- Downpayment: This is the amount of cash a buyer initially pays to the seller. In most cases, the amount is at least 10% of the total cost of the assets. After making the down payment, one can take home the items and even use them.

- Interest: This is the fee the buyer pays to the seller under contract. Interest arises from the fact that one is not buying items in cash. One is considered to be hiring the items during the period they are paying for the items. You only become an owner after the last installment.

- Goods: These are movables such as equipment, furniture, kitchen appliances, building materials, and electronics that a buyer acquires from the seller.

- Cost of goods: Cost is the cash purchase price plus value-added tax.

- Credit amount: it is the total cost of the items that one ought to repay to the seller when paying under hire purchase terms. It includes the down payment and installments and any other fees specified in the contract.

- Parties to the contract: These are the buyer and the seller.

- Payment schedule: It is the arrangement set in place for repayment of the assets.

- Payment due date: This is a set date when one ought to make payments to the seller when paying installments.

- Installments: These are periodic payments made by the buyer to the seller. Installments can be daily, weekly, or monthly payments.

- Fines: These are payments the buyer pays to the seller when they do not fulfill their financial obligations.

Find more helpful information demystifying hire purchase contracts here. Get the best deals at Kenya Credit Traders.