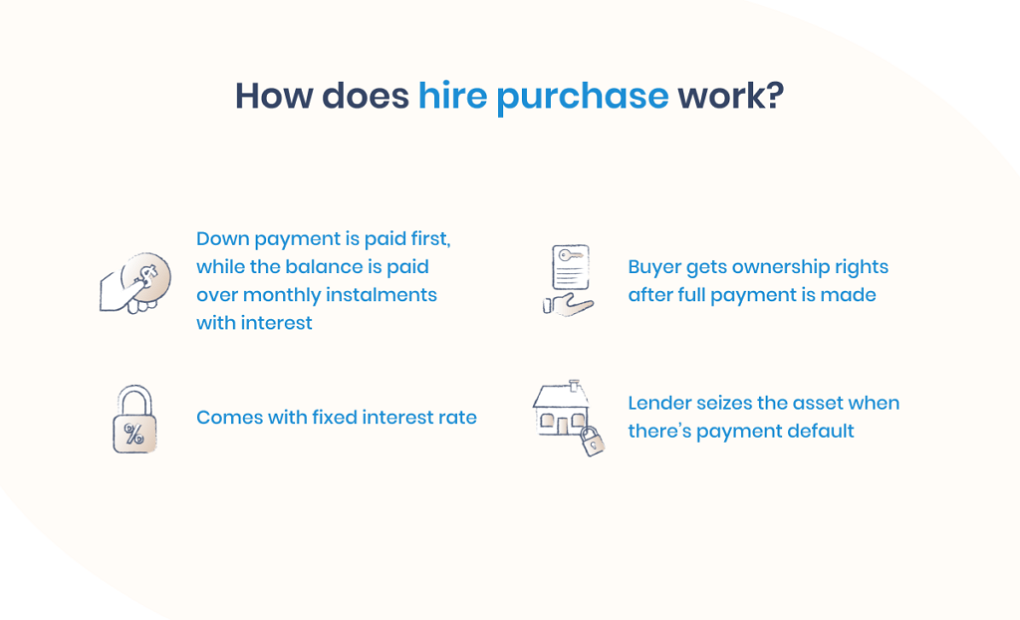

Hire purchase is the best financing option when purchasing items and you do not have all the cash upfront. Whether you are looking to enhance your home using the latest furniture sets, or you need a refrigerator for your business, hire purchase offers a good payment plan. In our other articles, we have highlighted the many benefits a buyer is set to enjoy if they opt to pay using hire purchase terms.

Considerations before signing any hire purchase agreement

It is essential to ensure that you are getting the best deal before you opt to sign a hire purchase agreement. Here are some vital aspects a buyer ought to keep in mind.

1. Do you require the asset to thrive?

Before opting to purchase any assets using hire purchase, it is vital to consider the current ones. Do they need to be replaced? Can you get rid of the current items to raise some capital for the new ones? As a buyer, it is essential to only spend on items that you require. This helps you to avoid spending too much money on unnecessary items.

Hire purchase, or lipa mdogo mdogo, is essential for items that you need in the long run. When you have a new home, you might opt to purchase a 4-seater mahogany dinner set, metal beds, or various sofa sets here on hire purchase.

2. Depreciation costs

Some of the assets that one can purchase on hire purchase depreciate over time. At the end of the agreement, some of the assets might no longer be useful or functional. Before spending on any item, it is vital to ensure that the depreciation cost is justifiable or even negligible in the long run.

3. Interest rates

Interest rates are part of the basic considerations before investing in any items using a hire purchase payment plan. In most cases, the deposit that one ought to pay is capped at least 20-30%. Interest rates make the difference in the total cost of the items when compared to cash purchases. Comparing deals between different companies ensures that you can always find the better deal.

4. Repayment terms

Apart from the interest rates, one also needs to consider the monthly installments before they sign any agreement. Late payments will mean that you incur penalties. On the other hand, lack of payment will see the seller repossess the items. You will end up losing the money you have fronted.

Visit our Blog page to learn more about hire purchases. Also, follow us on Facebook, Kenya Credit Traders to find the latest offers and deals.