How Hire Purchase Can Be A Beneficial Financing Option

When in the market for high value assets, there is no doubt that one will be eager to learn the financing options available to them. In some cases, one might have enough cash to carry out a cash purchase. However, there are instances when one doesn’t have all the cash to spend on a given asset they require for their business or home.

In some instances, a homeowner or a business owner turns to a lending institution to seek cash to fund the purchase. In the case of household items, one can turn to digital lenders to obtain cash and purchase a particular asset. However, the high interest rates charged on the short-term loans only work to increase the total cost of the asset.

Hire Purchase Financing Options With KCT

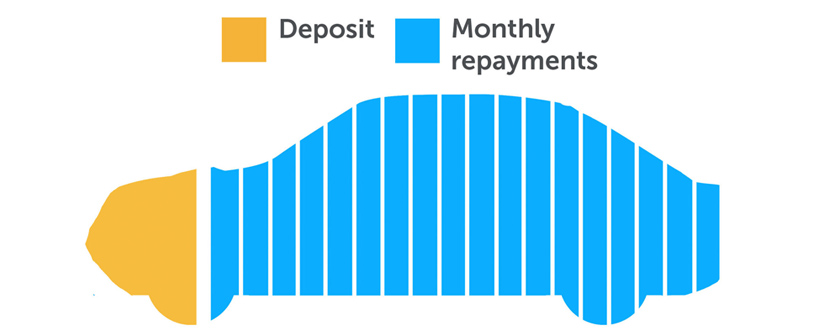

Hire purchase is quickly becoming a suitable way to pay for assets in modern times. With hire purchase, one acquires an item at just a fraction of the total cost. This initial payment is referred to as a down payment. After one makes the down payment, a hire purchase agreement comes into effect. They hirer has a duty to pay daily, weekly, or monthly installments until they pay the total cost of the item as well as the interest.

One of the best reasons to opt for hire purchase financing is that one is able to acquire assets they need immediately, even when they do not have all the cash to purchase the assets outright. If you are looking for kitchen appliances, you just require paying at least 10% as a down payment. The items will be availed to you by the dealer and you are allowed to use them. However, one can only become the owner after making all the payments.

It is also worth considering hire purchasing financing options with KCT, considering that this is an affordable way to purchase items. In the case of term loans, the interest rates are usually high. The interest rates are also subject to changes depending on the changes by the Central Bank of Kenya. In the case of hire purchase financing, interest rates are fixed. This means that the installments are fixed, and one can thus budget for their income appropriately.

Find more educative content about hire purchase on our blog page. Follow KCT on Facebook for incredible hire purchase deals.