The Legal Aspects of Hire Purchase Agreements You Should Know

Hire purchase is quickly becoming popular in modern times. Businesses and individuals looking to acquire assets are choosing hire purchase terms. This has seen hire purchase acquire special importance in the Kenyan economy. In the past, hire purchase has been seen as a way for businesses to acquire high-value assets such as vehicles and machinery. However, in modern times, even small but essential items such as telephones, household appliances, Televisions, and other electronics are available on hire purchase terms.

What is a hire purchase agreement?

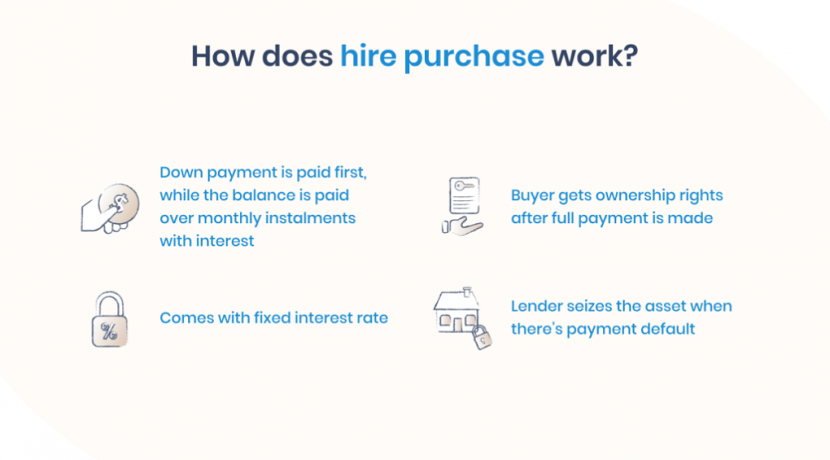

A hire purchase agreement is a contract that requires one to pay rent for a certain period after acquiring assets. These rent payments are defined as installments in a hire purchase agreement. In addition to a hire purchase agreement, one has to make a downpayment to the seller to acquire the assets. The customer acquiring the items is known as the hirer. While a hire purchase agreement acts as a contract of bailment, it also has an element of sale. When the hirer pays all the installments to the owner, the dealer transfers the title of the assets to them.

Legal aspects of a hire purchase agreement

1. Possession

Immediately the hirer pays the down payment to the owner of the goods, they can acquire them and utilize them.

2. Ownership

While the hirer acquires the goods immediately after paying the installment, they do not automatically acquire ownership. Ownership of the assets remains with the vendor or dealer. One only becomes the owner after they complete payments by paying all the installments.

3. Installments

Installments are among the core features of a hire purchase agreement. The installments act as a rent charge for the hirer to use the items in question. Since hire purchase is a financing option, interest is charged on the installments. This makes the total cost of the assets higher than the cost of a cash purchase.

4. Down payment

Before the hire purchase dealer transfers possession of assets to the hirer, they will need a down payment. While hire purchase agreements differ, in most cases, the down payment is a small fraction of the total cost of the asset. At Kenya Credit Traders, we provide assets for as low as 10% of the cost.

5. Repossession

Since the hire purchase dealer remains the owner of the assets, there are instances when they can repossess them. One of the major reasons for repossession is default in installments. Any other breach of the hire purchase contract can lead to repossession. The hire purchase dealer can also repossess the items when the hire purchaser voluntarily decides to surrender the assets to the owner.

Get incredible hire purchase deals here.