Difference Between Hire Purchase and Cash Purchase

Every buyer is keen to learn payment options available whenever they are in the market to purchase assets. Different items cost varying prices. For some items that don’t cost much, one will need to make an outright purchase. However, in some instances, you might not have all the money to purchase a particular item that you require. This is when one learns about other financing options such as hire purchase, leasing, or even taking a term loan.

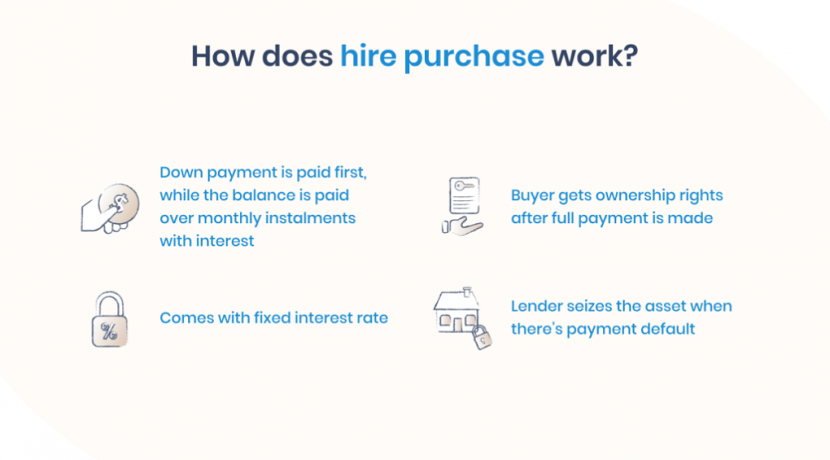

What is a hire purchase?

When you do not have all the cash to purchase household or business assets, hire purchase is one of the best payment options to consider. In this payment option, one just pays an initial amount of the total cost, known as the deposit. The balance is cleared in regular installments. After paying the deposit, you can acquire the asset to use as you clear the balance. You get assets such as refrigerators, household furniture, microwaves, fridge guards, and gas cookers among others on hire purchase at Kenya Credit Traders.

The difference between hire purchase and cash purchase

1. Impact on your cash flow

When you are purchasing outright, you will be paying all the required amounts of cash at once. In the case of a business, this will have an effect on your cash flow. Even in the case of household items, one might use all their savings on furniture, smart TV, or even a smartphone. When you choose hire purchase, it is a chance to spread the cost over a period of time. This will help you properly plan for your cash.

2. Ownership of the items

When one opts to purchase items outright, it will be the chance to own the item immediately. On the other hand, one immediately acquires the items after making the deposit. You have the chance to utilize the asset even before you acquire full ownership. However, one will only acquire ownership of the item after one makes the last payment.

3. Total cost of the item

In the case of a cash purchase, one can expect the cost of the item to be lower than the total cost of the same time on hire purchase terms. The interest is spread across the payment duration.

Visit our website and view the latest offers. Also follow us on Facebook, Kenya Credit Traders.